IMPLICATIONS ON THE DEFINITION OF EQUITY ON THIN CAPITALIZATION RULE UNDER THE FINANCE ACT 2022 AND LIMITATION OF DEDUCTABILITY OF INTEREEST EXPENSE

The thin capitalization rule, refers to limitation of deductibility of interest expenses, as results of equity and debt exceeding predetermine ratio, provided under the Income Tax legislation. In Tanzania under the Income Tax Act 2004 provides under Section 12 a debt to equity ratio of debt to equity of 7 to 3, whereas 7 is debt and 3 is equity. The tax implications is the limitation of amount of interest expenses where thin capitalization rules applies and the debt to equity ratio exceeds the provided limits. The excess amount of interest expenses over and above is disallowed for corporate tax purposes. The main focus is protection of tax base of the given tax jurisdiction

The thin capitalization is worldwide tax practice with more less the same intention and objectives of protecting the tax base focusing on the multinational enterprises and cross border transactions. For example in East Africa , Kenya has a debt to equity ratio of 3 to 1 Uganda has a more descriptive thin capitalization rule while Rwanda has a ratio of 4 to 1 debt equity ratio and many other countries around the world.

In principle the main focus on limitation of interest expenses targets the debt from the related / parent companies /associates parties , such that should not unnecessary introduce small amount of equity and large debts in order to extract income in the form of interest, simply because interest expense is deductible expense (return on debt ) and reduces the taxable income while the divided (return on equity) is not, by implications in the eyes of the tax law there is an incentive to introduce debt , rather than equity. Therefore the interest income is regarded as a form of income repatriation scheme.

There are genuine economic and commercial good reasons introducing debt rather than equity, though worldwide tax legislation it has been perceived as a scheme of repatriation of income from one tax jurisdiction say host country to home country. In the same way in Tanzania

In order to implement the intended objective the tax legislations, have specific tax provisions to address the implementation of the scheme, In Tanzania section 12 of the income Tax Act. 2004 address this issue, since 2004. This section mainly defined the word debt and equity in order to provide clarity in the implementation and administration of this section. The broader definition of the word “equity” for example includes the share premium, retained earnings etc. in addition to paid-up share capital will provide a broader amount based on which the debt will be compared. However, when the definition of equity is narrowly define for example it excludes share premium, retained earnings etc., it also limits the debt amount whose interest amount is deductible for corporate tax purposes.

The Finance Act, 2022, provided for limitation of the word “equity” to paid up share capital only and the balance at that end of the tax year of income. This is completely revised the existing definition word “equity” and exclude share premium, retained earnings which were part of the definition before 01 July 2022. The implication of the narrowed define word equity will consequently limit the amount of debt allowed under thin capitalization rule and amounts of interest expenses deductible for corporate tax purposes.

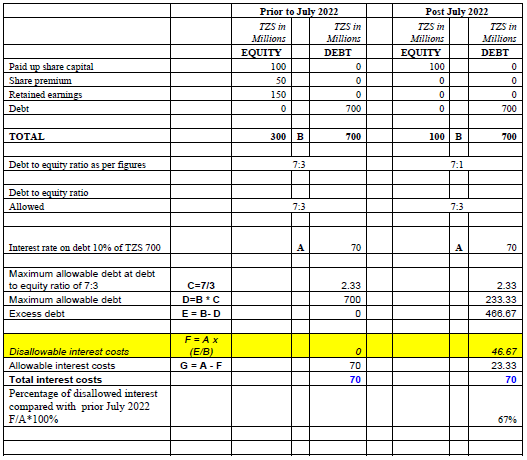

To assess the impact / magnitude of the amount of interest expenses that may be disallow, below is the illustrative / demonstration schedule / summary giving the comparative figures prior to Finance Act 2022 and post Finance Act 2022

Given the assumed figures in the above table the net effect of reduction of interest expenses in net increase of (…%) compared with the prior position. Based on this simple analysis it important that the entities subject to this rule to re-examine financing strategy as far as debt and equity financing is concerned.

On the hand can we then argue that opportunity exists for the domestic bank and financial institutions registered with the Bank of Tanzania, the debt from the domestic banking are not subject to this rule, this is also a subject for discussion and challenges to the domestic bank. The next point of discussion would the domestic banks having enough funds to financing multimillion dollars project where opportunity arises next question.

How will this revised thin capitalization rule apply for the Strategic investments approved by the National investment Steering Committee under the Tanzania Investment Act , upon which the Minister of Finance have powers to exempt Income tax. Will tax exemption provide exception to the thin capitalization rule, in the event that the project of heavily financed by debt. These are some of the thought / challenges and implications the revised definition of equity is likely to impact some business enterprises.

Comments are closed.